As the industry continues to evolve, banks and wealth managers face unique challenges and opportunities. Among these is the need to consolidate fragmented systems to improve operational efficiency and support future scalability. Additionally, the changing client demographics within the GCC are redefining service expectations, encouraging firms to explore ethical and faith-aligned (Islamic) investment solutions , discretionary portfolio management and Lombard lending. Harnessing technology will be crucial in addressing these dynamics and enabling the swift deployment of tailored services for the market.

A growing financial hub

The GCC countries, including the United Arab Emirates (UAE), Saudi Arabia and Qatar, have been actively diversifying their economies beyond oil and gas. Initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s Digital Economy Strategy exemplify these transformative efforts. Financial centres like the Dubai International Financial Centre (DIFC), Abu Dhabi Global Market and King Abdullah Financial District have emerged as significant magnets for international investment. These hubs benefit from robust regulatory frameworks, open economies and substantial wealth accumulation, making them attractive destinations for wealth management services.

Fiduciary duty and value enhancement

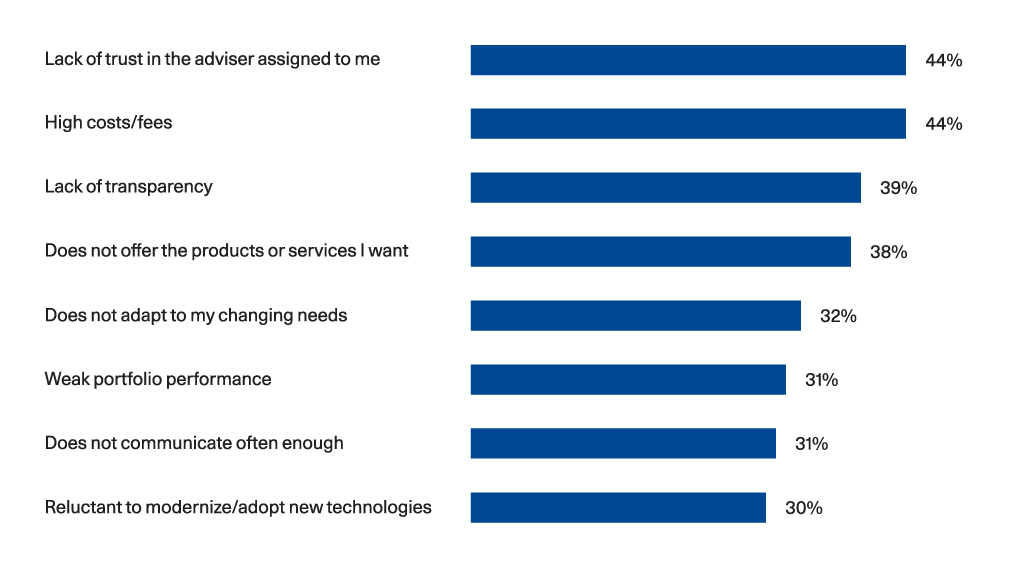

Wealth management practices in the GCC are becoming increasingly aligned with global standards, emphasizing client-centric and fiduciary business models. This shift enhances value for clients by promoting fee transparency and delivering personalized advisory services. Avaloq’s research highlights the importance of such practices in client retention. For instance, affluent to ultra-high-net-worth investors in the UAE cite lack of trust in the adviser assigned to them by their bank or wealth manager (44%), high fees (44%), insufficient transparency (39%) and an inadequate product or service range (38%) as the main reasons for considering a change in their financial provider.[1]

Figure 1: Why UAE investors would consider switching financial provider

A sophisticated clientele

Avaloq’s research also shows that over half (54%) of UAE investors have been assigned an adviser by their bank or wealth manager, with whom they communicate at least weekly (22%). Nearly one-third of these investors expect to hear back from their adviser within at most a few hours (31%). Multi-channel availability of advisers plays a crucial role in building trust, as noted by 82% of investors. Furthermore, over half of respondents value the proactive sharing of relevant news articles (61%) or new product offerings tailored to their needs (58%).

Industry challenges

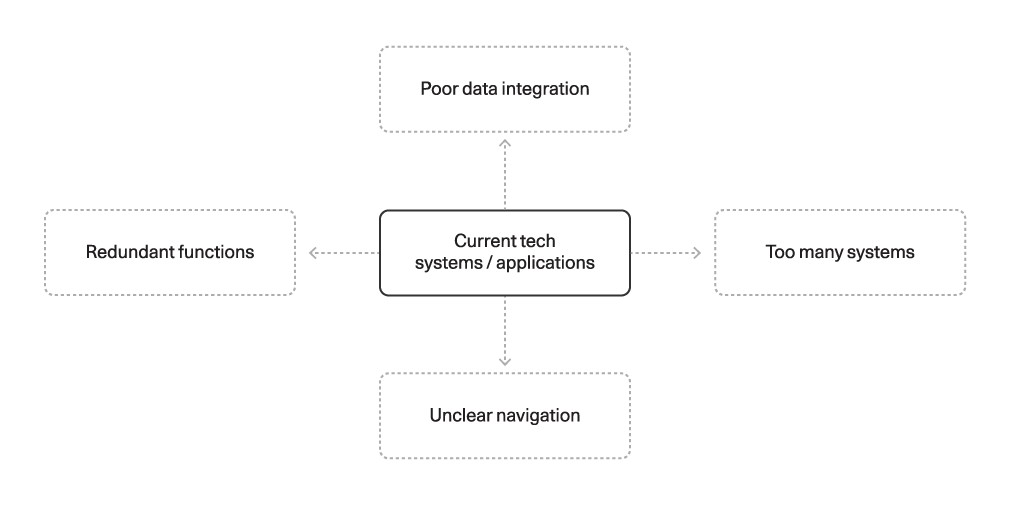

According to Avaloq’s research, investors in the UAE express higher satisfaction with their primary financial institution’s digital services compared to their international counterparts (87% versus 77%). Nevertheless, Middle Eastern firms still face hurdles to achieving sustainable growth. The increasing demand for wealth management services has driven many firms to adopt multiple specialized technology solutions. These systems often lack seamless data integration, include overlapping functionalities and provide interfaces that are not optimized for user experience. This fragmented approach reduces operational efficiency and compromises data accuracy.

Figure 2: Top four tech pain points for UAE wealth managers[2]

Unified technology solutions for enhanced efficiency

To thrive in the Middle East’s competitive wealth management industry, firms must prioritize adopting unified technology solutions that boost efficiency, scalability and client satisfaction. By integrating systems into a single, cohesive platformthat combines front, middle and back-office operations, wealth managers can achieve a complete view of client relationships across key areas such as investment advisory, portfolio management and custody services. Transitioning from fragmented systems to a unified platform not only streamlines processes but also equips firms to embrace innovations like artificial intelligence (AI) and machine learning by ensuring access to consolidated and accurate data.

Avaloq’s commitment to the region

Acknowledging the region’s immense potential, Avaloq has recently established a new office in the DIFC. This strategic move highlights Avaloq’s dedication to fostering technological advancements in the Middle Eastern wealth management sector and supporting the region’s ongoing growth and modernization efforts. We are eager to contribute to strengthening the GCC’s position as a premier international wealth management hub and look forward to working closely with the region’s leading financial institutions.

- Source: Avaloq 2024 investor survey, conducted among more than 3,000 individuals with investable assets of USD 250,000 or more in 11 international markets, including the UAE.

- Source: Avaloq 2024 industry survey, conducted among almost 350 wealth management professionals in 11 international markets.