Das sagen unsere Kunden

Als bewährter Partner der Finanzbranche sind wir stolz darauf, über 170 Banken und Vermögensverwalter in 35 Ländern mit unseren führenden Technologielösungen und

-dienstleistungen zu unterstützen.

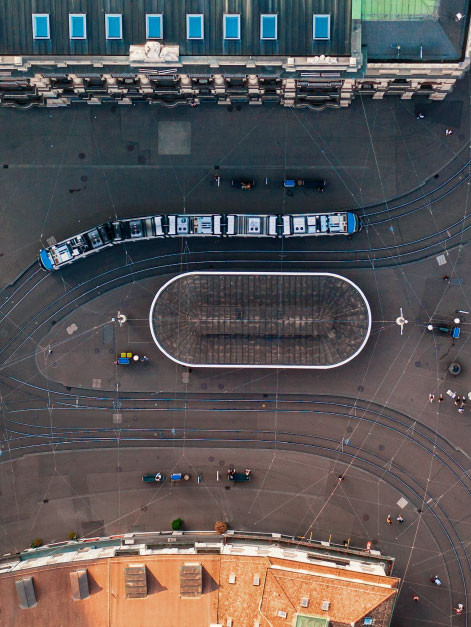

BT Panorama and Avaloq: More than a decade of growth and innovation

“By using Avaloq as our core technology, we were able to consolidate multiple systems into one central core, which really simplified our business processes and increased operational efficiency.” Greg O’Donoghue, Head of Technology at BT.

UnionBank: Scaling wealth management business efficiently

Avaloq joined UnionBank on their journey to digitally transform their wealth management business. Our core wealth platform will allow the bank to cater to the growing needs of their wealth clients and expand their business more quickly and efficiently.

LGT: Expansion in fünf Länder und Steigerung der verwalteten Vermögen um 370% in zehn Jahren

«Heute verwenden alle unsere Bankeinheiten dasselbe Bankensystem. Das bringt Synergieeffekte und führt zu einem hohen Grad an operativer Effizienz.» Dr. André Lagger, CEO LGT Financial Services, berichtet, wie Avaloq die Wachstumsambitionen von LGT seit 2009 unterstützt.

«Mit der Verlagerung unserer Wealth-Management-Plattform in die AWS Public Cloud ebnen wir den Weg für weiteres Wachstum in der Region. Die SaaS-Lösung von Avaloq bietet uns die nötige Flexibilität und Skalierbarkeit, um unser Leistungsversprechen einzuhalten. Indem wir unser traditionelles Private-Banking-Angebot auf die neuen digitalen Plattformen von Avaloq ausrichten, können wir das Kundenerlebnis optimieren und unsere Kundenbetreuerinnen und -betreuer dabei unterstützen, ihrer Kundschaft bei der Erreichung ihrer finanziellen Ziele zu helfen.»

Terence Chow, Head of RBC Wealth Management, Asien

«Dank Avaloqs integrierter Plattform und einheitlichem Datenmodell verfügen wir über saubere, konsistente und verwertbare Daten in der gesamten Organisation – die Basis für zukünftige KI-Anwendungen. Diese Transformation stärkt unsere Fähigkeit, unsere Kundschaft agiler, transparenter und präziser zu betreuen und Dubais Position als globales Finanzzentrum weiter auszubauen.»

Vinod Yadav, Head of Technology, Emirates Investment Bank

«Aufgrund der veränderten Lebensgewohnheiten der Menschen werden Bankdienstleistungen, die über digitale Kanäle angeboten werden, immer beliebter. BKB und Bank Cler reagieren auf diese Entwicklung und investieren in eine hochmoderne Web- und Mobile-Infrastruktur, um ein nahtloses, durchgängiges digitales Kundenerlebnis zu schaffen. In Anbetracht unserer langjährigen Partnerschaft mit Avaloq sind wir zuversichtlich, dass dieses Projekt ein wichtiger Meilenstein auf unserem Weg der digitalen Transformation wird.»

Basil Heeb, CEO, Basler Kantonalbank

«Wie in vielen ähnlichen Branchen ist auch in der Vermögensverwaltung ein starker Trend zur Digitalisierung zu beobachten. Unser Ziel ist es, unsere Kundschaft bei der Optimierung ihrer Portfolios zu unterstützen, indem wir erstklassige Anlagelösungen für sie entwickeln. Wir freuen uns auf die Partnerschaft mit Avaloq, um ein hochgradiges Kundenerlebnis zu schaffen.»

Austin Luo, Head of Private Wealth Management, Haitong International

«Die Partnerschaft mit Avaloq unterstreicht unseren Anspruch, führend in der Innovation im Wealth- und Investment-Management zu bleiben. Indem wir unsere Prozesse auf einer integrierten, zukunftsfähigen Plattform vereinen, legen wir das Fundament für langfristiges Wachstum und zusätzlichen Mehrwert für Anlegerinnen und Anleger.»

Humberto Coelho, Gründer und Strategieverantwortlicher, BTA Finance Limited

Fragen? Wir sind für Sie da!