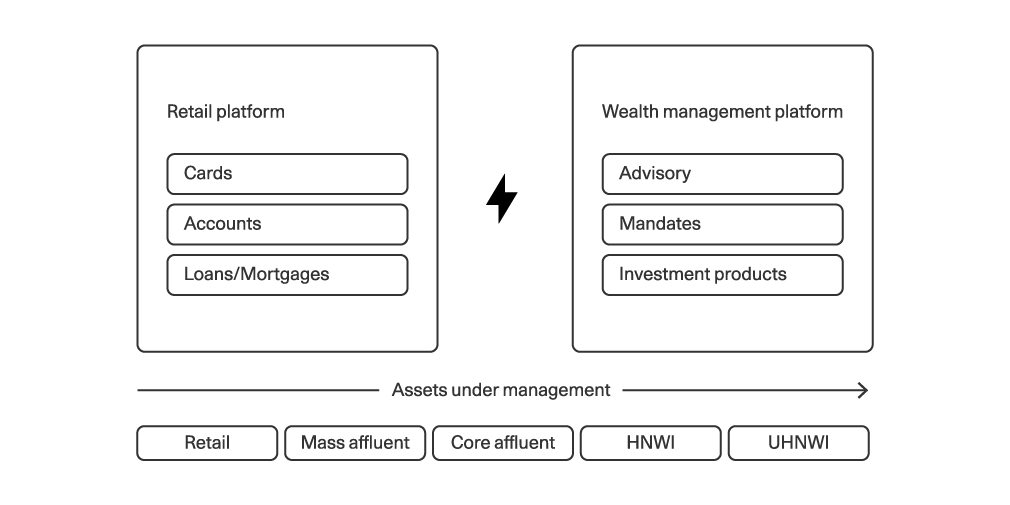

We often observe that large financial firms operate on separated systems to serve their retail and wealth management clients. This lack of integration is increasingly disruptive to the relationship management experience, as it significantly impedes growth and limits wealth managers' service to investors.

Wealthy investors use credit cards, make payments, and take out mortgages. In fact, affluent, high net worth and even ultra-high net worth investors share the same needs as retail clients. Delivering these services effectively means that client data needs to be duplicated in a bank’s wealth management and retail client relationship management software – meaning that client data is held in two separate systems to fulfil a wealthy investor’s financial needs. This not only complicates the adviser’s life, increasing the cost of onboarding, but also the investor’s experience, due to the additional data capture, requirements, and login processes.

This is also true for a retail client whose assets are increasing. At some point, they must be “handed over” to a financial firm’s wealth management division to receive the relevant financial advice. This stage is often facilitated by internal incentives, potentially resulting in a break in coverage of the client at a crucial – and likely stressful – point in their relationship with the bank. The failure to merge retail and wealth management services clearly comes at a high cost. It is not only inefficient, but it does also not support the financial progress of a retail or affluent client who wishes to increase assets under management with the support of their bank’s services.

Retail and wealth management platform gap

Restricting efficient relationship management and investment advisory to affluent segments

Shifting client expectations call for bridging the data divide

Wealthy client expectations are also shifting toward the kind of convenience and user-friendliness that consumer industries are accustomed to. Digital natives of all client segments are tech savvy and expect financial information to be available in the palm of their hand as seamlessly as possible. Financial advisers need to meet with clients on their terms and provide an element of freedom around certain transactions themselves. Self-service tools take on greater importance by enabling clients to complete tasks quickly and interact with advisory personnel in flexible formats through multiple digital channels. Such tools support advisers through augmented and natural language processing capabilities, artificial intelligence, and machine learning. However, such technology cannot operate on scattered core systems with separated platforms for client segments. If solutions to respond to these client needs are implemented in an unintegrated platform environment, the result is a fragmented user experience for clients, advisers, or both.

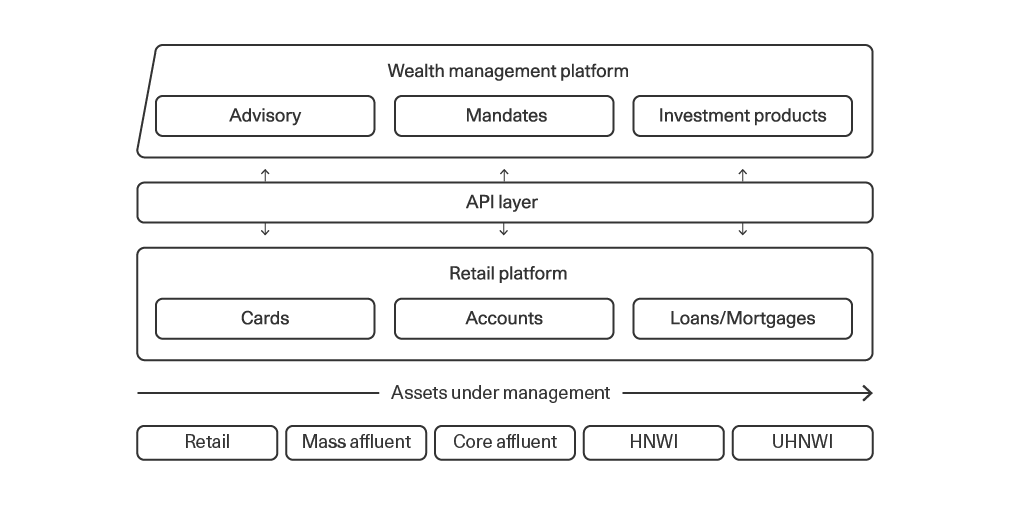

Efficiently integrated retail and wealth management platforms

Creating a unique data source per client and enabling investment advisory at scale to affluent segments

Cases for successfully bridging the data divide

Avaloq has extensive experience across Asia Pacific and Europe to address the limited or inexistent integration of retail and wealth management systems. Without disclosing sensitive information, we have provided examples of three cases below.

1. Delivering advice to a new generation of investors in Singapore

A major bank in Singapore needed to increase their offering to address a younger generation, which had recently started accumulating greater wealth. The integration of retail and wealth management services was quickly identified as a key factor to delivering seamless, high-class service and advice for the end client. The solution involved the integration of Avaloq’s fourth-generation Core Banking Platform. Through the integration, wealth management clients now have access to retail services, such as drawing a mortgage, without reaching out to the retail arm of the bank. Their financial advisers also benefit by being able to keep track of their clients’ overarching wealth portfolio and basic needs in a single workplace.

2. Scaling the investment product offering in Southeast Asia

Another Southeast Asian bank, having relied heavily on legacy infrastructure to offer its products and services over the past decade, identified a major bottleneck in its systems, restricting business growth. The bank realized that purchasing a new system to provide new product types would only add to its already segregated infrastructure and exacerbate operational inefficiencies. Avaloq advised the bank to revamp its operational view across all client segments. It helped the firm adopt an upgraded retail core to complement the Avaloq Wealth platform. The new “combined” operating model enhanced scalability in terms of range of products and service offerings. Time to market for new products was notably shortened and cross-selling across segments rose significantly. The bank can now easily identify high-value clients in each segment and offer them upgraded services.

3. Bridging best in class self-service client experience with advisory in the UK

To address the client desire to have the choice of their preferred channels, Avaloq helped another European private bank ensure that payments, trades and other transactions can be executed online through mobile apps by clients themselves, with on-demand access to the advisory team. The bank required a combination of flexible transactional end-user interface software, an ecosystem of third-party specialist providers and robust integration capabilities that enable the various components to communicate with each other in real time. Avaloq orchestrated the different self-service and advisory elements into a seamless client experience for wealth management clients.

Bridging the data divide correctly

Avaloq’s experience with numerous global financial firms has made it clear that the best way to increase internal efficiency and client engagement is by establishing a unique source of client data. This provides a solid foundation for organizations to innovate quickly and ramp up digital client channels (mobile, web banking), enabling efficient client management and greater overall client satisfaction.