Solutions

We enable our clients to offer world-class banking and investment management in multiple regions and across different segments. Our platform is both comprehensive and flexible, allowing us to meet regional product and regulatory requirements and adapt when new ones emerge. We can cater to any business model with a range of services and deployment types including on-premises, software as a service (SaaS) and business process as a service (BPaaS).

As a trusted partner in the financial services industry, we help banks and wealth managers to meet the growing needs of their clients and increase efficiency via automation.

Regional expertise

A multinational presence coupled with deep local knowledge of products and regulations.

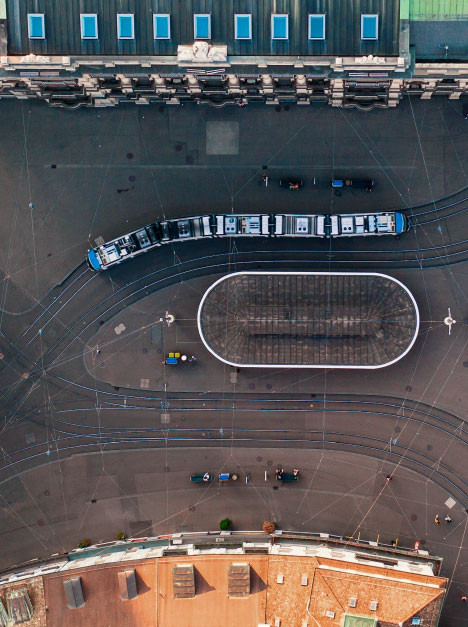

Our head office in Zurich, Switzerland is the central hub for our clients in Switzerland and Liechtenstein and brings extensive banking and wealth management technology expertise and experience to our offering.

Our coverage of the European region is managed from locations across the region, with hubs in the UK, Germany and Luxembourg to maximize our local expertise.

We cover the APAC region from our offices in the Middle East, India, Singapore, Hong Kong, Australia and the Philippines and we have established local teams in Japan, but our rich and diverse client community extends throughout the region.

We are continuously expanding our client base into markets that need our products and services. Get in touch to find out more about whether we are exploring your market.

Segments

We have been supporting financial institutions to serve different client segments since 1985.

Wealth management and private banking

We cover the entire wealth value chain from the front to the back office. Our client management capabilities enable your advisers to spend more time with clients while our investment management capabilities allow you to exceed their expectations with hyper-personalized advice at scale.

Retail banking

We enable you to offer your clients an enhanced multi-channel experience at lower cost. Our web and mobile banking solutions give clients an intuitive digital banking experience while our platform’s automation potential lets you scale faster by processing back-office operations more efficiently.

Corporate banking

We offer a range of solutions for corporate banking. Our payments capabilities include out-of-the-box features for business users while our compliance capabilities, such as local regulatory monitoring teams, are specifically adapted to the corporate segment, allowing you to focus all your efforts on serving your clients.

Aladdin by BlackRock

Find out how Avaloq’s pre-integration with Aladdin Wealth™ by BlackRock could help grow your investment management business.

170+ clients worldwide run on Avaloq’s platform

“By moving our wealth management platform to the AWS public cloud, we are paving the way for further growth in the region. Avaloq’s SaaS solution will provide us with the necessary flexibility and scale to deliver our proven value proposition to the market. By aligning our traditional private banking offering with Avaloq’s new digital platforms, we will be able to optimize the experience for our clients, and support relationship managers in delivering on clients’ financial objectives.”

Terence Chow, Head of RBC Wealth Management – Asia

Discover our capabilities

Find out how we meet the needs of banks and wealth managers on one comprehensive front-to-back platform.

Digital channels

Show your clients you understand their needs with a hyper-personalized web and mobile experience.

Client management

Equip your front office with fully integrated capabilities designed to simplify any client journey.

Investment management

Harness powerful portfolio management and investment advisory capabilities to grow your business.

Trading

Manage the full trading process from order management, routing and execution to settlement.

Lending and credit

Offer your clients a wide range of products with end-to-end coverage from initiation to ongoing risk management.

Payments

Get complete payments coverage in multiple markets and across all major protocols and standards.

Treasury, risk and compliance

Stay compliant with regulation and manage risk across products and multiple jurisdictions.

Data analytics

Access insights from core banking via the latest data extraction and streaming technology.

Integration

Connect with third-parties and benefit from pre-integration with selected best of breed partners.

Want to learn more about our solutions? Contact us today for further information on how we can help your business grow.