A traditional wealth management portfolio typically consists of shares, bonds and funds. These are, by definition, financial assets and therefore “bankable”. Other things that make up personal wealth may be of value as well, but are often excluded or managed independently from more traditional assets in a wealth management portfolio. Think of direct investments in companies or private equity funds, the purchase or co-acquisition of primary or secondary residences, pieces of art and rare collectibles, and the like. These items do not appear on your bank's portfolio report and are, by definition, non-bankable assets. In saying that, they have a current value, an expected value development, and an inherent risk – just like any other asset.

Characteristics of non-bankable assets

The exact definition of non-bankable assets can vary from source to source. A characteristic feature is a certain illiquidity that prevents their inclusion in a wealth portfolio as well as often their acceptance as collateral to guarantee a loan. Reasons for the illiquidity are volatile prices, relatively high minimum investments – such as when investing in luxury real estate or fine art – and the expert knowledge needed to assess the current value of such an asset. Between the absence of a market with frequent trades of similar assets and the often-unique character of an individual asset, experts with detailed knowledge are required to determine a price and, in some cases, to find a buyer, as well. This is the domain of intermediaries, such as real estate agents, notaries, art experts or auction houses.

In summary, we characterize non-bankable assets as those assets which are:

- Not part of a wealth management portfolio

- Often rejected as collateral for a loan

- Illiquid with often high minimum investments

- Difficult to valuate and trade

Forms of non-bankable assets

Non-bankable assets can come in a variety of forms. In the list below, we focus on a few categories that should be of specific interest for wealth managers.

Rare collectibles

- Fine art collections

- Classic cars

- Jewellery

- Rare wines

- Antiques

Real estate

- Luxury, primary residences

- High-end, secondary residences

Private equity

- Direct investments in privately owned companies

Intellectual property

- Patents

- Trademarks

- Copyrights

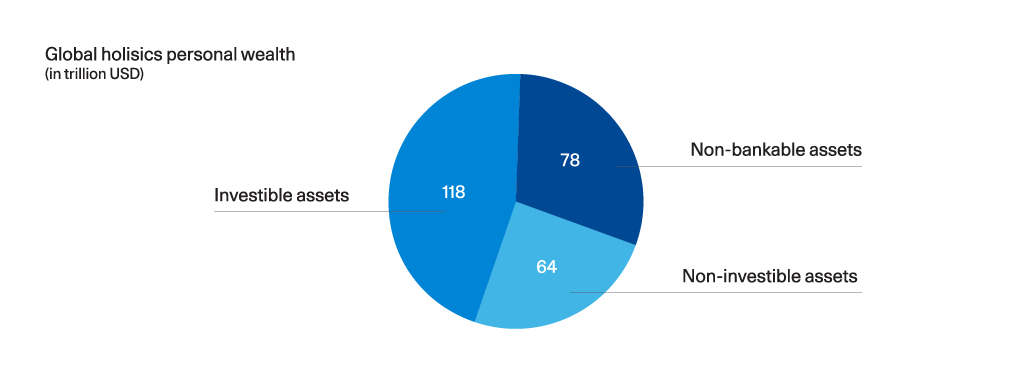

Global market volume of non-bankable assets

Source: Accenture-Orbium Wealth Management C-Level Survey 2020

A 2020 report from Accenture-Orbium estimates the value of global personal wealth to be USD 260 trillion. Of this amount, USD 78 trillion is categorized as non-bankable assets, including real estate, privately owned businesses, art and other passion assets. The majority of personal wealth is invested in equities, bonds, funds or held in cash (USD 118 trillion or 45%). Another quarter is locked in life insurance and pension products (USD 64 trillion or 25%). This leaves 30% of non-bankable assets. [1]

Challenges for non-bankable asset investing

The significant share represented by non-bankable assets is a unique opportunity for wealth managers to extend their assets under management and create new advisory offerings. However, the opportunity comes at a cost. Wealth managers need to overcome a number of challenges to enable non-bankable asset investing.

Valuating non-bankable assets

To include an asset into a portfolio, it is a precondition to have a regular and accurate valuation for its current price and an indication of the future value development. The traditional solution to that challenge is to call in experts and specialized firms who could, as a partner of the bank, regularly valuate assets. As outlined in other publications, a supplement – or even substitute – to such partnerships are modern machine learning models, which could help to valuate some kinds of non-bankable assets.

Creating liquid markets

For an asset class to become mainstream, investors must be able to buy and sell it at will. This asks for liquidity – and the way to create it is to lower minimal investments and to get rid of administrative and legal hurdles around exchanging the assets. Once investors can buy fractions of an asset to participate in its expected value growth, platforms will pick up the demand and offer the marketplaces for them. The technology to enable fractional ownership and easier exchange is tokenization. Exchanging tokens, the digital twins of the assets, is much easier than the traditional way of trading.

Seeking regulation

While tokenization is the technological answer to speeding up non-bankable asset investing, it is not the sole factor in creating new marketplaces for digital assets. To win the trust of investors, the trade with tokenized assets needs to follow established regulations. The current patchwork of fragmented national legislation and regional efforts for alignment are not sufficiently advanced to allow for the setup of token marketplaces, let alone interregional or global trade. To allow tokenization to reach its full potential, the industry must seek guidance from regulators and collaborate to create the new market rules.

Linking the digital and physical asset

The last challenge is ensuring a stable link between the digital and the physical world. While an investor may have a fraction of a painting or a real estate object safely stored as tokens in their portfolio, who can make sure that the physical asset behind it still exists and is in a good condition? What happens with the investment when an asset is stolen or lost in a fire? A wealth manager may specialize in delivering this link for a certain asset class, but, often, it will ask for a trusted intermediary to provide that link. Think of a real estate company that manages and maintains buildings or a gallery which stores or exhibits an art collection in the possession of investors.

Why invest in non-bankable assets

With all the technological, regulative and organizational hurdles to be overcome, easy access for retail and mass-affluent investors to non-bankable asset investing may sound like a faraway dream of the future. But there are strong reasons to include these asset classes in traditional wealth management and simplify their trading. First, with their inclusion in banking, it will become easier to use these assets as collateral for a loan – a promising perspective for ultra-high net worth investors who are rich on assets but lack liquidity for new projects or investments. Moreover, the fractional ownership of such assets lowers entry hurdles and invites retail and affluent investors to consider these new asset classes to diversify their portfolios. If the industry starts to embrace tokenization and manages to create well-regulated and liquid markets for tokenized non-bankable assets, it is very well possible that they will soon find their way into everyone's portfolios – and so will no longer deserve to be labelled as “non-bankable assets”.