The platform for world-class banking and wealth management

Transform your business with our comprehensive platform that meets the demands of the most complex financial institutions.

The Avaloq platform brings together over 40 years of experience in developing sophisticated financial software with the best-in-class technology from the financial ecosystem.

Benefits

Efficiency

Optimize your front-to-back-office processes to boost operational efficiency. Achieve straight-through processing rates of up to 99%.

Growth

Generate sustainable growth via premium client service. Increase revenue per adviser by as much as 10%.

Speed

Increase speed with our scalable platform available in the cloud. Expand into new markets in as little as six months.

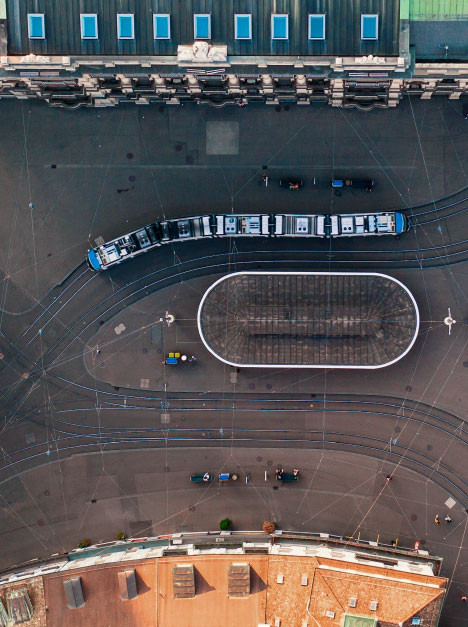

Over 170 clients worldwide run on Avaloq’s platform

Leading the way in wealth management technology

Comprehensive capabilities

Our platform covers all major financial products across Europe, Asia, the Middle East and Africa, and new products can easily be added. We support everything from initiation through to treasury, accounting and compliance on one integrated platform.

Connected ecosystem

Our platform is built on a modern open architecture, enabling integration with third-party systems, client-specific interfaces, and standard protocols. This ensures smooth interoperability, scalability, and an optimized user experience.

Reliable services

Our platform can be delivered alongside Avaloq managed services and IT operations, offering end-to-end solutions. We can enhance these services further with our specialized expertise in Banking Operations to deliver streamlined back-office processes.

Flexible delivery

Our platform can be delivered as a ready out-of-the-box solution, SaaS Go. It is also available as software as a service, a flexible platform as a service or as an on-premises deployment for full control over your bank.

Advanced security

Our platform’s database architecture provides high levels of protection, with all data modifications handled through a single code base. The security, reliability and availability of the platform has been tried and tested across jurisdictions and business models.

Scalable cloud

Our platform enables you to access cloud transformation seamlessly and securely, while staying compliant with local regulations. We orchestrate leading-edge cloud infrastructure services to bring you the benefits of cloud, without the hassle.

Discover our capabilities

We support over 100 financial products with full front-to-back-office integration across your entire value chain.

Digital channels

Show your clients you understand their needs with a hyper-personalized web and mobile experience.

Client management

Equip your front office with fully integrated capabilities designed to simplify any client journey.

Investment management

Harness powerful portfolio management and investment advisory capabilities to grow your business.

Trading

Manage the full trading process from order management, routing and execution to settlement.

Lending and credit

Offer your clients a wide range of products with end-to-end coverage from initiation to ongoing risk management.

Payments

Get complete payments coverage in multiple markets and across all major protocols and standards.

Treasury, risk and compliance

Stay compliant with regulation and manage risk across products and multiple jurisdictions.

Data analytics

Gain insights from the latest core banking data via advanced extraction and generate reports and visualizations.

Integration

Connect with third parties and benefit from pre-integration with selected best-of-breed partners.

Ecosystem

Extend the capabilities of your platform with innovative partner solutions in the Avaloq ecosystem.

Want to learn more about our platform? Contact us today for further information on how we can help your business grow.