Discrepancy in communication methods

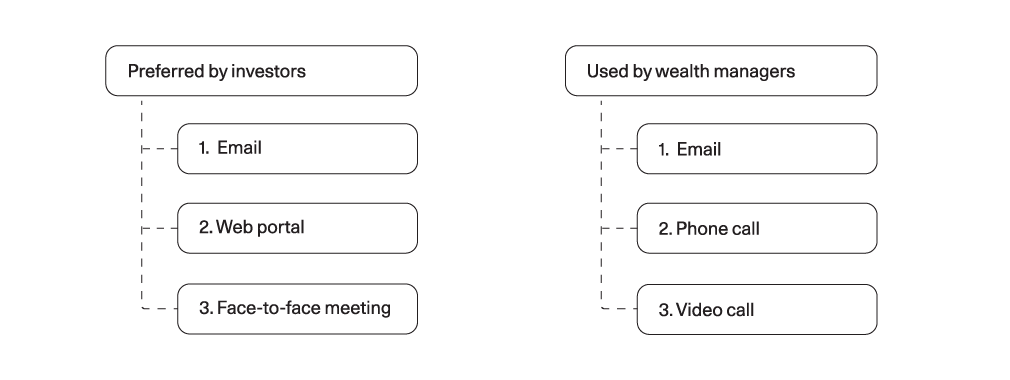

Avaloq’s research reveals that wealth managers in the UK struggle to keep pace with their clients’ changing communication needs. According to the study, which surveyed affluent to ultra-high net worth investors as well as wealth management professionals, clients are increasingly favouring newer, digital forms of communication, while wealth managers still rely on more traditional means.

Web portals and mobile banking apps are underused

The research found that nearly half of wealth managers in the UK rarely or never use their own web portals (46%), with only a smaller proportion relying on them frequently or all the time (28%). Mobile banking apps are even more underused by wealth managers, with more than half of respondents rarely or never using them to communicate with clients (56%). In contrast, email remains the dominant communication method for wealth managers (91%), followed by phone calls (80%) and video calls (69%). However, among these, only email appears in the top three communication preferences of investors, while video calls are in the bottom three.

Figure 1: Top three communication methods

Investors favour email and web portals

Meanwhile, client preferences are slowly but steadily shifting towards digital channels, with 49% of UK investors favouring email and web portals, up from 34% in 2023 and 39% in 2022. Moreover, a majority prefers to manage financial tasks like placing a trade (52%) or understanding their portfolio performance (51%) independently through digital channels. Over the same period, the popularity of face-to-face meetings and phone calls combined has hovered around 31 to 32%. The latter is likely to remain constant since clients will always want to speak to their adviser in person or over the phone before making big life decisions, like taking out a mortgage or starting a business.

Clear and timely communication builds trust

Avaloq’s research underscores the importance of wealth managers aligning their communication channels with their clients’ preferences. Clear communication (92%) is the most crucial factor for UK investors when it comes to trusting their adviser, with quick response times (64%) following closely. Being available on multiple channels is important for 58% of investors. Not communicating often enough would be considered a reason for switching wealth managers by 37% of UK investors, while 42% would do so for a lack of transparency, including unanswered questions.

Digital platforms offer untapped potential

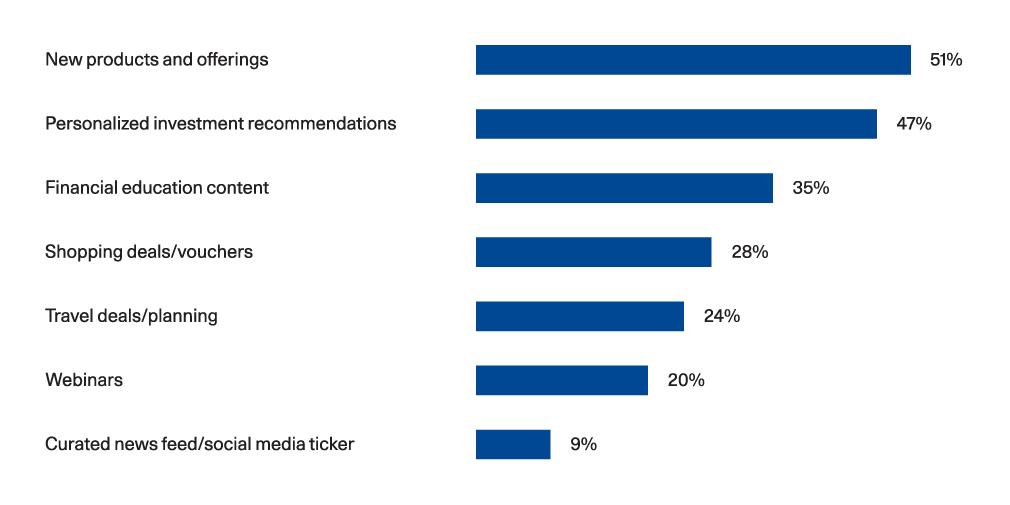

One-third of UK investors log into their web portals and mobile banking apps at least once a day. Additionally, around half of respondents express an interest in seeing new products (51%) and personalized investment recommendations (47%) on these platforms. Given low usage of these channels among wealth managers, this represents a missed opportunity for wealth managers to further engage with their clients and to recommend relevant offerings.

Figure 2: What UK investors would be interested in seeing in their web portal or mobile banking app

Building on a solid foundation

As the financial industry continues to digitalize and wealth passes to younger, digital-savvy investors, client demand for wealth managers who provide clear, concise communication through modern, digital channels will only increase. Avaloq’s research shows that investors in the UK place a high value on transparency, trust and personalized engagement. They expect their wealth managers to proactively share relevant news, product offerings and investment analytics.

The good news for UK firms is that clients’ satisfaction with the digital experience provided by their main financial institution has risen from 64% in 2023 to 85% in 2024 – one of the highest levels in our survey. [1] By aligning their communication strategies with the evolving client preferences highlighted in this article, wealth managers in the UK are in a prime position to continue improving client satisfaction and engagement. This will ultimately allow them to retain a competitive edge in a rapidly changing industry.

- Sum of “satisfied” and “very satisfied” in response to: How satisfied are you with the digital experience provided by your main financial institution?