Operational excellence across all key back-office processes

Drive performance, support growth and unlock innovation with Avaloq’s intelligent Banking Operations.

Leverage advanced automation and AI to streamline labour-intensive processes. Increase efficiency and reduce operational risk while empowering your teams to focus on high-value activities.

Your brochure is ready

Benefits

Operational excellence

Achieve up to a 99% straight-through processing rate, with as close to 100% service accuracy as possible by combining the Avaloq platform with advanced back-office automation.

Cost optimization

Reduce back-office running costs by up to 30% with Avaloq’s pay-per-use model. Leverage our banking specialists' expertise to identify and eliminate inefficiencies by focusing on process optimization.

Intelligent operations

Utilize AI and automation to streamline processes such as corporate actions by decoding unstructured data like SWIFT and PDF text, enhancing quality and reducing manual effort.

Reliable services

Ensure compliance with ISO standards through proactive monitoring and management of processes to prevent issues, optimize performance, and deliver reliable, high-quality service.

Banking Operations in detail

Your back-office operations with the highest levels of automation.

Your brochure is ready

Reliable banking operations with built-in control

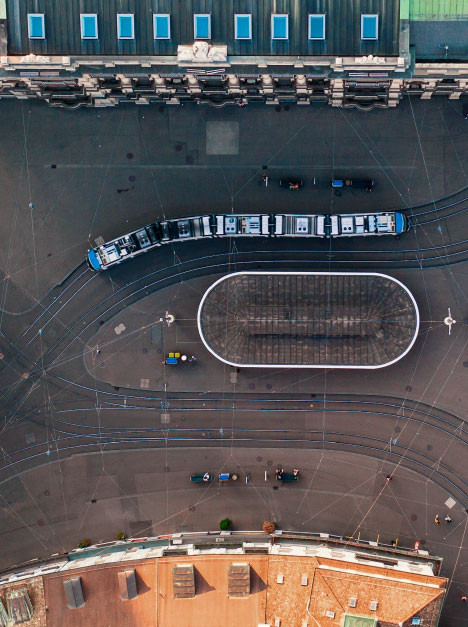

With decades of experience in providing back-office services, Avaloq’s banking specialists are recognized for delivering high-quality, timely operations through our BPaaS (business process as a service) model. Operating six service centres across four countries, we harness the strengths of a global workforce to drive skill-based efficiencies and apply best practices from diverse labour markets. Our near-shore and off-shore options give clients the flexibility to tailor their sourcing strategies, and a strong focus on quality and efficiency underpins our exceptional service delivery. Enabling near real-time monitoring and automation of routine tasks, our experts are empowered to concentrate on high-value activities, minimizing errors and enhancing performance. Today, over 30 banks trust Avaloq to manage their back-office processes.

Highlights

- Skilled banking specialists with extensive experience in complex and varied client networks to meet diverse global business needs.

- With over 200 live robots and projects with Google Gemini, we are driving innovation and shaping tomorrow’s banking solutions.

- High-quality and reliable services with over 110 automated real-time monitored risk controls ensuring operational integrity and compliance.

Avaloq Banking Operations are available across all our delivery models.

SaaS Go

Accelerate your time to market and reduce the need for extensive customization or development with a comprehensive, ready-to-use solution. Avaloq provides all the necessary components to launch and operate a digital bank or financial service quickly, efficiently and at lower cost.

Your brochure is ready

Software as a service (SaaS)

Let Avaloq manage your banking landscape end-to-end allowing the customization of specific components and integration of third parties. Outsource all operational tasks, mitigate risk and reduce the burden on your teams allowing the focus to stay on your core business.

Your brochure is ready

Platform as a service (PaaS)

Benefit from full flexibility to build, deploy and manage your banking capabilities while Avaloq manages the underlying infrastructure. Innovate faster and accelerate development cycles, allowing a quick response to market changes and an improved client experience.

Your brochure is ready

On-premises

Keep complete control over the Avaloq platform and its configurations by deploying on your own data centre. Supporting extensive customization options, on-prem deployment enables self-management, leaving you free to design and manage your solution independently without restriction.

Avaloq clients using our Banking Operations services

More than 30 banks trust Avaloq as a reliable partner to manage their back-office processes

“Avaloq has successful BPaaS installations in local and global banks in Europe and Asia. This offering has grown in credibility after a few years in the market and is a differentiating factor for this vendor.”

Vittorio D'Orazio – Senior Analyst at Gartner

Want to learn more about Banking Operations at Avaloq? Contact us today for further information on how it can make a difference to your business.