What factors are driving innovation in open banking? Can the platform economy really work for the banking industry?

Financial institutions have been understandably concerned over recent developments which obliges them to share control of customer account data. While some fear this can lead to a loss in revenue, it also presents a whole host of new opportunities that banks are in a prime position to exploit. Open banking provides banks the opportunity to create a platform economy where they are the platform and with enough incentives, can act as innovation magnets.

The innovations in this open banking platform economy are driven by various forces which all market participants seek to control. These forces are the main drivers that are spurring innovation in open banking – the ecosystem itself, user experience centricity and data.

The ecosystem

A company in the platform economy succeeds by allowing others to innovate on its platform. In the case of Apple, for example, millions of developers create and sell apps and Apple shares in the profit. Had they used just the staff on its payroll, they would never have been able to produce the millions of diverse ideas that only a platform economy can deliver.

Having innovators on the platform is just one variable in the equation though. Creating a platform that attracts them in the first place is an obvious pre-requisite. Why should innovators choose a particular platform over another? In the case of the open banking platform economy, the app developers have to be incentivised to choose a particular platform to build apps on. Banks have already been wooing innovators and trying to get a head start.

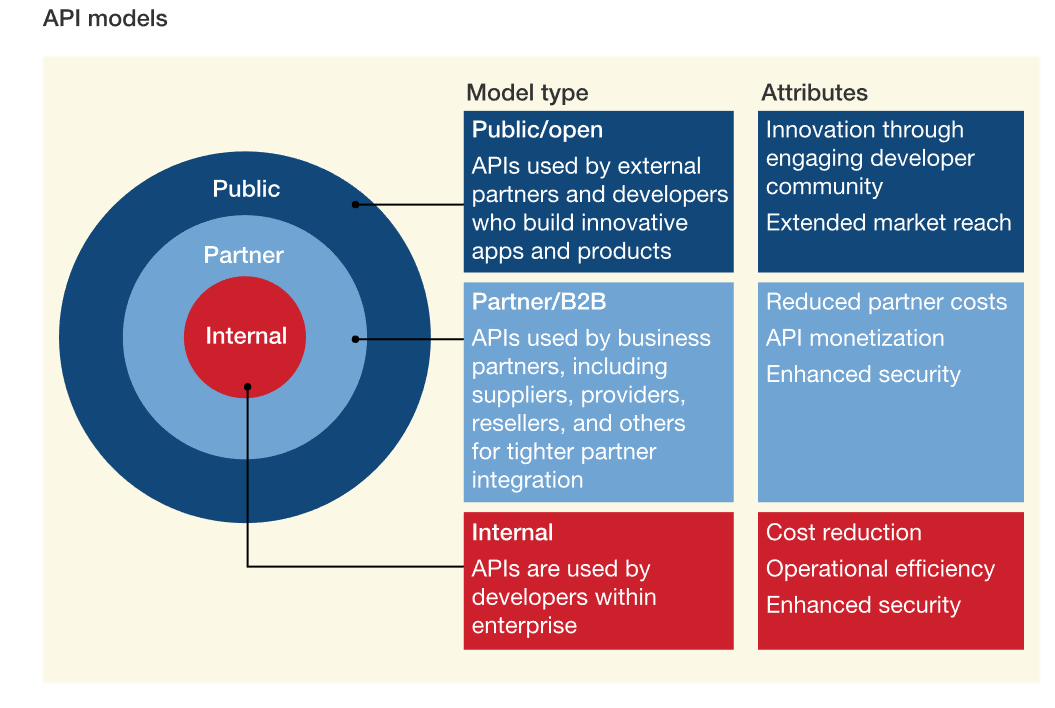

The graphic below shows the various API models that can be used in open banking or any similar platform economy for that matter.

The three models for Open Banking APIs. Source: McKinsey

The internal model is the most restrictive but offers better control and more security. The fully public model can potentially provide maximum innovation and a broader reach, but at the cost of reduced control. Regulations governing the sharing of information like GDPR and PSD2 also come into play here and while they may seem restrictive, they often come bundled with tools (like eIDAS for example) which help address some of the problems.

The user experience

From the perspective of regulators and consumers, the idea behind promoting open banking is to improve the experience of the end customer. In a seamless digital market place, the consumer will have more trust in spending cash online and will be able to do it faster and easier. This will lead to an increase in consumer confidence and greater spending, potentially leading to a boost in consumption and the economy. For banks looking to succeed in this open banking platform economy, they need to understand these motivations of the regulators and the consumers.

Let’s consider the case of a bank that provides its clients with a plethora of applications that can help them meet all their financial products and service requirements. Right from making payments to borrowing, shopping, paying bills, investing, researching financial products – everything is available on that bank’s platform. In addition to all of these things that we can think of, there will undoubtedly be hundreds of others that we didn’t think of - but someone else has.

With all of these products and services available in just one place, that customer never has to leave the bank’s platform. Just like Amazon wants its users to get everything on their platform, banks too need to build full-service platforms populated with multiple options to meet each of its customer’s needs. Of course, the client experience has to be curated by ensuring that they only get to use quality products and that their experience is consistent. The trust in such scenarios must come from the bank’s platform itself while the innovation will come from the third-party app developers.

The data (and what you do with it)

The third driver of innovation in the open banking platform economy is data or rather how it is used. Data is one of the greatest assets that banks possess. It is this data which allows them to build credit risk models and it is this data which allows them to structure and price new products and services. Banks have historically guarded this data zealously and not just from a competitive advantage standpoint – but from a security perspective as well.

How then, can banks use their data treasure troves in the era of open banking where consumers are empowered to share their account data with other service providers?

By moving fast. Whatever opportunities are available to BigTech and FinTech firms are available to banks as well. If they can create the most desirable ecosystem, then it gives them the opportunity to service their competitors clients as well. And maybe over time on-board that entire client relationship.

Data is, in fact, so valuable that there are multi-billion-dollar companies that provide their services free of cost, just to get access to that data and then monetize it. Over time, consumers are becoming more cognizant of the value of this data and that heralds the next chapter of the data economy.