In the first article of this series, we looked at the vast scale of wealth creation taking place in the GBA (Greater Bay Area), and at some of Avaloq’s proprietary research that indicates how large the opportunity is for banks and wealth management firms to serve the people driving this growth.

Now, let’s reach an understanding of the amalgam of traditional and modern demands that GBA clients and prospects have, as these will significantly impact how executives strategize to meet this demand.

To do this, we will start with their most basic characteristics and get more granular from there. Needless to say, this portrait will be done in broad strokes, but our intent is to orient executives to the types of demands they will encounter in the region.

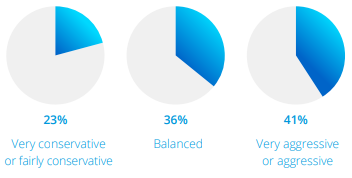

First, let’s consider the region’s investor’s risk appetite in general, which will impact every aspect of the portfolio that will win their confidence and share of wallet. Our data indicates that GBA investors break down like this:

A new take on traditional goals

A younger cohort in a vibrantly growing region might be expected to skew aggressive when asked to characterize themselves.

However, when asked the purpose their investments would serve, we get a deeper look into their mindset. Fully 60% of them indicated that they invested to provide for “future personal health care costs”, and 43% invested for “retirement income”, both of which are long-term objectives that indicate a mature understanding of fiscal responsibility.

Many of them intend to use their investments to benefit their families, with more than half saying that their portfolio would help them provide for their children and nearly a third expecting to tap it to care for their elders. This commendable commitment to family may be the most traditional aspect of these investors’ ambitions.

But their commitment to community goes just as deep. While nearly a third of them expected to use their portfolio to support “charitable donations [or] societal good”, a staggering 91% of our survey respondents “must have” or “would switch” to get portfolios serving their Environmental, Sustainability and Governance (ESG) goals, with over two thirds of them saying they were already ESG investors.

However, these investors are serious about their ESG goals and will not fall prey to slick greenwash marketing. They want to know that their investments will truly have the impact their providers claim they will. We found that 62% of our survey respondents question whether sustainable investing opportunities are truly sustainable.

There is a tie-in between their caution and their long-term, family-oriented goals. Evidence continues to mount that there is a causal relationship between market performance and alignment with ESG goals. Real economic returns, especially long-term, family-sustaining returns like the ones GBA investors want, will accrue more readily from companies who are honestly making a difference. GBA investors seem to appreciate this, and they intend to invest accordingly.

It seems reasonable to expect that advisors who can substantiate their analysis of ESG goals and investments with relevant news and insights will make the more compelling case to their clients. Given the extreme importance of this investment strategy to the GBA cohort, solid, data driven ESG analysis may be key to obtaining new clients and share of wallet.

A new approach to wealth creation

Since GBA investors are surrounded by entrepreneurial vibrancy in a fast-growing economy, it should come as no surprise that 43% of them invest with an eye to someday supporting their own entrepreneurial dreams.

While solid ESG planning is clearly a requirement for attracting and retaining these clients, it is equally important to offer cutting-edge instruments. They not only want to have a positive impact, but they also want to invest to develop the next generation of technologies and investment opportunity.

Many prognosticators have suggested that China cannot simply imitate established investment protocols from the West. To equal or surpass Western wealth creation, they will need to innovate and to create new methodologies.

Perhaps aligning with that expectation, we found that 85% of our survey respondents “must have” or “would switch” financial service providers to get portfolios including cryptocurrencies, despite China’s recent crackdown on energy-hungry crypto miners.

What seems to matter is supporting next-generation wealth management technology, which may well use the blockchain extensively. To substantiate that supposition, we found that two out of five GBA investors would be “excited” to have NFTs or tokenized non-bankable assets (such as fine art) in their portfolio.

To a certain extent, we may think of ESG goals as the “family-oriented” part of a GBA-targeted wealth management strategy, while the blockchain appeals to the ‘entrepreneurial, growth-oriented’ goals of the same targeted investor. Both are new and innovative ways to think about investing, aligning the investor with the region’s need to leapfrog existing wealth creation methodologies rather than imitate them.

Modern communications

Every client—new, old, advisory or discretionary—wants free flowing communications with their advisors. When we asked our survey respondents why they might leave an advisor, communications topped their list, with nearly half saying they would switch if their advisor did not communicate often enough.

This strikes at the core business processes of banks and wealth management firms targeting new wealth in the GBA. Digital natives taking on Silicon Valley expect to work with professionals who are also digital natives. That means they wish to work with advisors and bankers who are in the flow of communicating with them effortlessly.

Not long ago, lapses in communications spanning a day or two might have been considered a normal cadence. For today’s hyper-connected digital native, lapses of such length will seem like an eternity, deserving to be derided with the ominous term “ghosting”.

Clients and prospects will have questions; they always do. Advisors who answer them gracefully and substantively build confidence. Those who don’t risk alienating GBA clients who are digital natives surrounded by fast-paced innovation.

Aligning with this neatly, our data indicates that about half of GBA investors are excited about the idea of conversational banking, meaning they are excited about using texting apps such as WeChat for communication with their advisor or banker. More than 90% of them also said they “must have” or “would switch providers to get” a state-of-the-art mobile app.

Alpha in today’s market arises from a deep understanding of this new face of investing. ESG goals serve the community, the world, and the bottom line. New technologies and creative wealth creation methods are cultural and historical imperatives. Adopting modern communications and the pacing that goes with them establishes trust and reinforces the perception of alpha.

Even as these are key to winning and retaining clients, they also cause an explosion of complexity that threatens to muddle elegant portfolio creation, render client presentations incomprehensible, and tangle back-office administration.

To meet these new demands profitably, wealth management firms and banks need to rethink their own operations from the bottom up. We will turn to these operational considerations in our next and final article in this series.