ABAKA Next Best Action: AI recommendation engine for customer engagement

Key features

- Intelligent Nudges

- Behavioural persona segmentation

- Omnichannel delivery and digital customer communication

- Library of 5000+ pre-curated marketing templates

- Insights and Analytics suite to demonstrate campaign and nudging effectiveness and penetration into your constituency

Description

AI-powered recommendation engine for increased customer engagement and digital customer experiences. ABAKA’s AI-powered Next Best Action is an AI-recommendation engine helping financial institutions deliver hyper-personalized engagements to their customers and build a truly customer centric ecosystem across their range of products and services. Harnessing the power of machine learning and behavioural persona segmentation, ABAKA’s AI-powered Next Best Action augments customer data with other sources of data to predict and deliver the relevant Next Best Action to the right customer, through the right channel, at the right time. ABAKA’s library of modular applications helps enterprise clients power hyper-personalised and behavioural nudges, big data insights, conversational AI, financial dashboards and outstanding customer experiences. Major financial institutions including HSBC and Prudential license ABAKA's technology to 10+ million customers who receive ABAKA’s hyper personalized recommendations on products such as credit cards, loans, savings, retirement, life and non-life insurance. Proven results include: up to 500% increase in engagement, 38% increase in Net promoter Score (NPS), increase in product conversion from 3% to 31%.

Company description

ABAKA is an award-winning provider of artificial financial intelligence solutions to the financial industry. Our AI-powered recommendation engine helps financial institutions deliver hyper-personalized customer experiences and build a truly customer centric ecosystem across their range of products and services whilst our innovative technologies enable global financial institutions to power digital saving and retirement solutions to their retail customers at scale. ABAKA’s AI-powered library of modular applications helps our enterprise clients power digital customer experiences with intelligent nudges, machine learning, behavioural persona based segmentation, and 5000+ pre-curated marketing templates delivering outstanding digital customer experiences. Our solutions cover retirement (accumulation, at-retirement and decumulation), retail banking (e.g. personal finance management, digital savings), workplace financial wellness, and wealth management (retirement account tracing and aggregation, advisor tools and business process automation). Today institutions such as HSBC, Prudential, Legal & General, Natwest, and St James’s Place are licensing ABAKA's technologies to deliver to services their retail and wealth customers with: (1) Intelligent Behavioural Nudges: machine learning models and AI-powered recommendation engine to identify persona segmentation, power personalised insights and nudges to increase engagement and up-sell opportunities, across digital channels. (2) Conversational AI: on retirement, savings and investments, for both fully digital and hybrid advice. The proprietary Natural Language Processing models take vast quantities of user behavioural and financial data to intelligently manage a human like conversation. (3) Digital financial dashboards & account consolidation service: a fully supported asset consolidation service (advised and non advised, with advisors support), including data aggregation technology powering Open Banking, Retirement & Saving dashboards, Account Tracing and consolidation service. (4) Financial Planning Engine: retirement planning, cash flow modelling, suitability assessment, Monte-Carlo simulations for outcome & scenario driven advice.

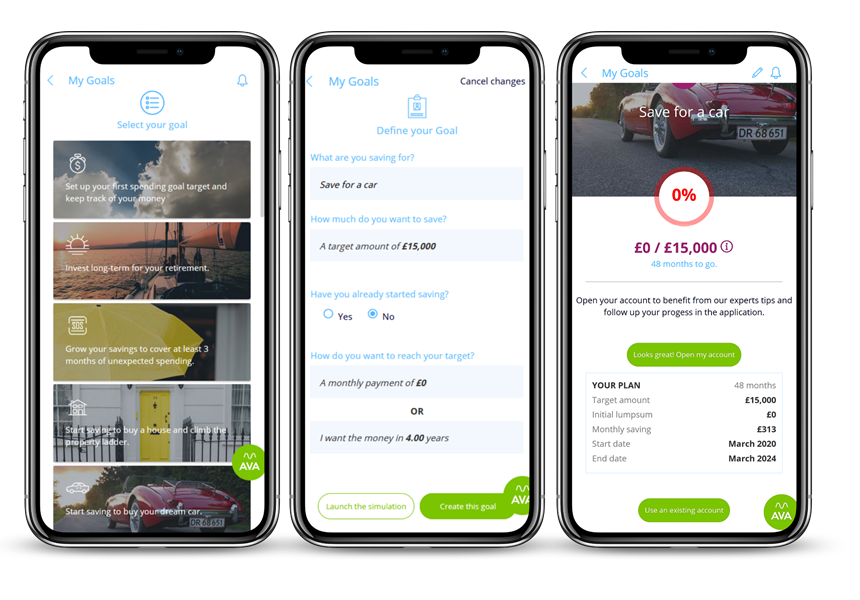

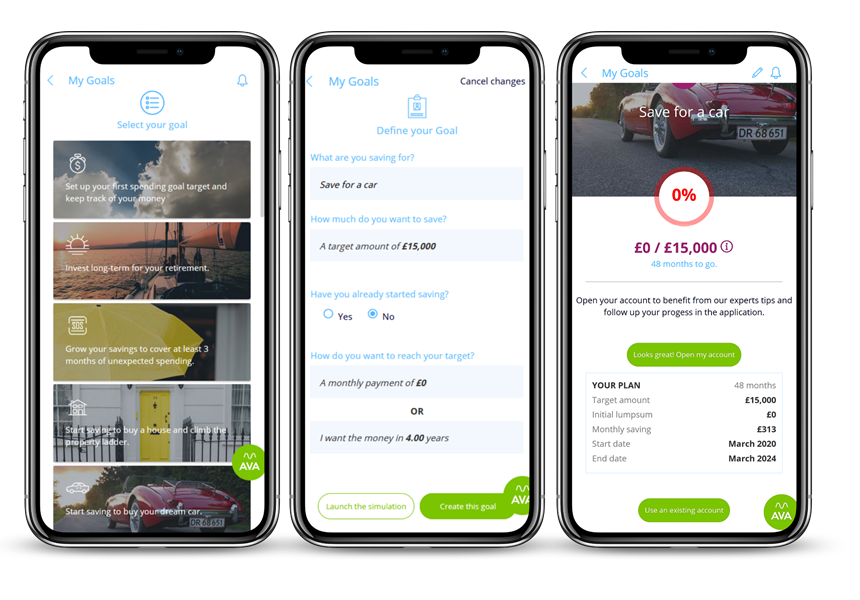

Preview

Key features

Key features

- Intelligent Nudges

- Behavioural persona segmentation

- Omnichannel delivery and digital customer communication

- Library of 5000+ pre-curated marketing templates

- Insights and Analytics suite to demonstrate campaign and nudging effectiveness and penetration into your constituency

Description

Description

AI-powered recommendation engine for increased customer engagement and digital customer experiences. ABAKA’s AI-powered Next Best Action is an AI-recommendation engine helping financial institutions deliver hyper-personalized engagements to their customers and build a truly customer centric ecosystem across their range of products and services. Harnessing the power of machine learning and behavioural persona segmentation, ABAKA’s AI-powered Next Best Action augments customer data with other sources of data to predict and deliver the relevant Next Best Action to the right customer, through the right channel, at the right time. ABAKA’s library of modular applications helps enterprise clients power hyper-personalised and behavioural nudges, big data insights, conversational AI, financial dashboards and outstanding customer experiences. Major financial institutions including HSBC and Prudential license ABAKA's technology to 10+ million customers who receive ABAKA’s hyper personalized recommendations on products such as credit cards, loans, savings, retirement, life and non-life insurance. Proven results include: up to 500% increase in engagement, 38% increase in Net promoter Score (NPS), increase in product conversion from 3% to 31%.

Company description

ABAKA is an award-winning provider of artificial financial intelligence solutions to the financial industry. Our AI-powered recommendation engine helps financial institutions deliver hyper-personalized customer experiences and build a truly customer centric ecosystem across their range of products and services whilst our innovative technologies enable global financial institutions to power digital saving and retirement solutions to their retail customers at scale. ABAKA’s AI-powered library of modular applications helps our enterprise clients power digital customer experiences with intelligent nudges, machine learning, behavioural persona based segmentation, and 5000+ pre-curated marketing templates delivering outstanding digital customer experiences. Our solutions cover retirement (accumulation, at-retirement and decumulation), retail banking (e.g. personal finance management, digital savings), workplace financial wellness, and wealth management (retirement account tracing and aggregation, advisor tools and business process automation). Today institutions such as HSBC, Prudential, Legal & General, Natwest, and St James’s Place are licensing ABAKA's technologies to deliver to services their retail and wealth customers with: (1) Intelligent Behavioural Nudges: machine learning models and AI-powered recommendation engine to identify persona segmentation, power personalised insights and nudges to increase engagement and up-sell opportunities, across digital channels. (2) Conversational AI: on retirement, savings and investments, for both fully digital and hybrid advice. The proprietary Natural Language Processing models take vast quantities of user behavioural and financial data to intelligently manage a human like conversation. (3) Digital financial dashboards & account consolidation service: a fully supported asset consolidation service (advised and non advised, with advisors support), including data aggregation technology powering Open Banking, Retirement & Saving dashboards, Account Tracing and consolidation service. (4) Financial Planning Engine: retirement planning, cash flow modelling, suitability assessment, Monte-Carlo simulations for outcome & scenario driven advice.

Preview

Preview